Stuart Thompson, President of ABB’s Electrification Service Division, which is at the forefront of innovative electrification, discusses how industrial replacement culture is fundamentally ending as companies shift towards intelligent asset stewardship.

THE ENERGY CONTROL IMPERATIVE – WHAT 2026 DEMANDS

Walk into any boardroom discussion about industrial power in 2026 and you’ll hear different questions than a year ago.

It’s no longer about whether you have enough electricity but whether you can control it before your competitors do.

Stakeholders are discussing how to deploy electricity intelligently and how to adapt as demands accelerate. Because in volatile markets, those who wait are already behind.

The past year highlighted the challenges facing energy systems globally. We saw grid operators issue warnings about capacity constraints, significant renewable curtailments in Europe, and critical infrastructure experiencing outages that affected millions.

Meanwhile, artificial intelligence (AI) and data centres have introduced power requirements that continue to grow exponentially.

Against this backdrop, Europe is revisiting baseload generation strategies including nuclear as they balance renewable integration with grid reliability.

The companies moving fastest aren’t waiting for grid solutions. They’re deploying storage systems, building control capabilities, and turning energy management into competitive advantage, whilst their competitors treat it as an unavoidable cost.

FROM EXPERIMENT TO COMPETITIVE ADVANTAGE

Energy storage has crossed a threshold. What began as sustainability pilots are now appearing on capital allocation agendas as core infrastructure investments.

The shift is most visible in the UK, Ireland, Japan, and Australia – markets where volatile energy costs and capacity constraints have turned power management into a profit and loss issue.

What’s changed is the risk profile. Energy storage as a service eliminates the traditional question of whether the investment will pay off over time because the value accrues from day one.

By eliminating the need for large upfront investments, the model sidesteps the usual obstacles: financial risk, technology becoming outdated, and disposal costs.

There’s also a notable shift in ownership. Finance teams are driving these decisions because energy costs are now material to competitiveness.

Where pricing fluctuates, the calculation is brutal – manage your energy costs or let the market control them for you.

Sitting on the sidelines is no longer an act of neutrality; It’s actively ceding ground to early movers.

This dynamic is playing out across industrial infrastructure. AI workloads have pushed power requirements in some facilities to levels that seemed implausible just five years ago.

Infrastructure designed for 30-year lifecycles now requires major upgrades every decade, and sometimes sooner. The old playbook is finished.

Install-and-maintain has given way to continuous modernisation, and for data centres where downtime costs millions an hour, phased upgrades that incorporate new technology without shutting down operations are now the norm.

But this pressure extends beyond data centres. Any business where technology demands outpace infrastructure planning – which these days, means most of them – faces the same choice; adapt continuously or watch competitors pull ahead.

THE FUTURE OF FIELD SERVICE

There’s another problem no one’s talking about enough – industrial electrical systems are becoming exponentially more complex, but the expertise to maintain them is disappearing.

In the UK alone, predictions suggest that by next year, nearly 20 percent of the engineering workforce will have retired.

Globally, the picture is similar, where experienced engineers are leaving faster than new ones can be trained.

Much of what they know is experiential – what a failing transformer sounds like, how a particular installation behaves under stress – which means traditional mentoring can’t scale fast enough to transfer this knowledge before it walks out the door.

One senior engineer can only train so many juniors before retirement.

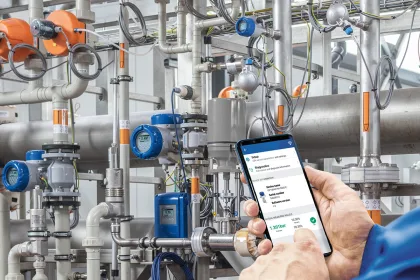

The key is to multiply expertise through technology. Remote diagnostics mean one specialist can support multiple sites simultaneously.

Augmented reality systems allow senior engineers to guide less experienced technicians through complex procedures in real-time, essentially putting expert knowledge into their hands exactly when needed.

Digital response can be immediate even when physical presence takes hours, which is critical when facilities require support in minutes rather than days.

The role has changed too. Today’s electrical engineers are increasingly data scientists who work with electricity – designing systems that monitor themselves, predict failures, and optimise energy use automatically whilst calculating carbon impact alongside electrical load.

The technical depth hasn’t diminished. The shift is in how we multiply that expertise through digital leverage, or it doesn’t scale at all.

WHAT THIS MEANS FOR 2026

What I’m seeing across markets is clear – businesses are taking direct control of their energy supply rather than remaining entirely grid dependent.

They’re responding to both competitive pressure and sustainability commitments. Where predictable costs and reduced emissions align, energy management becomes both strategically and financially compelling.

What’s enabled this is business model innovation. Service-based approaches that eliminate upfront capital requirements and guarantee performance have made direct energy oversight accessible to a much broader range of organisations.

The companies acting decisively in 2026 aren’t necessarily the largest. They’re often the ones recognising that energy security is too critical to delegate entirely.

The infrastructure constraints of 2025 made the stakes visible. How businesses respond in 2026 – whether they take control or remain passive consumers – will determine who builds advantage and who explains to boards why competitors moved faster.

Waiting for someone else to solve your energy problem is a choice – just not a strategic one.