The life sciences cold chain logistics space, particularly within the Asia Pacific theatre, continues to expand and develop in response to the investments being made by both public and private enterprises in the region, as well as the emergence of precision therapies moving through the pipeline.

In fact, according to a recent Allied Markets Research Report, the life sciences cold chain logistics field in the Asia-Pacific region is anticipated to grow at a rate of 18.7 percent a year through 2022.

Perhaps the most prominent new trend in pharmaceutical cold chain logistics is the arrival of cellular therapy products, notably cell and gene therapies. The first to market of these so-called therapies are CAR-T cell therapies, which depend on extracting T cells from a patient, reworking the cells’ genetics and then re-infusing to the same patient.

The emergence of regenerative medicine as a viable therapy class has amplified the focus on current clinical product distribution standards and the need for enhanced requirements that parallel current manufacturing standards in the industry. The regenerative medicines market generated $17.03 billion in revenue in 2016 and is expected to reach $50.55 billion by 2025.

CAR-T cell therapy is the most rapidly growing area of research in the pharmaceutical industry, and the Asia Pacific region is playing a disproportionate role in the emergence of regenerative medicine companies and new therapies in development. China is quickly racing to be a large player in this space and aims to introduce CAR-T therapies into the mainstream, most recently having 116 CAR-T trials, 20 more than the 96 currently registered in the US. It is anticipated that the APAC region will experience an annual growth rate of 38.6 percent through 2023 in the regenerative medicine space.

Moving cell therapies from the manufacturing site to the site of clinical administration is no simple task. First, fresh blood must be collected from the patient, processed, and either shipped at 2-8℃ or -196℃ to the manufacturing site where it is modified into a therapy. Both methods require specialised packaging and have demanding transit times that leave little room for error. The challenges can be further compounded if these materials need to move from one country to another which introduces complex customs requirements for the movement of human cellular material between countries. Having robust, redundant processes, equipment and informatics is critical to success.

The new drug products developed through regenerative medicine are more fragile and valuable than tablets or pills, and if they are damaged in shipment, it’s not visually obvious. They don’t change in smell, or colour. Even a slight temperature deviation could render the product unusable. In an instant, a therapy worth $475,000 can be destroyed. Yet even those outcomes are not the worst imaginable. The products involved are often patient-specific and entirely irreplaceable, and the patient needs are critical. Small mistakes can literally become a matter of life or death.

Traditional processes and procedures have been insufficient in supporting such complex supply chains. One common observation is that current cold chain container qualification and management processes are insufficient in effectively managing risk during regenerative medicine distribution. Basic requirements outlined and used for the manufacture, including traceability of equipment utilised in the manufacture and storage of drug substance and drug product, must be implemented and utilsed in the drug distribution space.

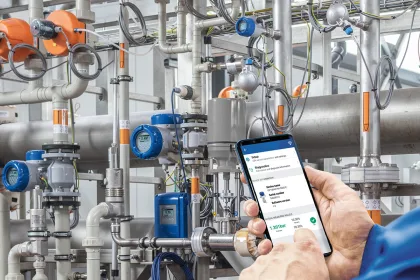

Newly emerging Chain of Compliance requirements for regenerative medicine distribution are rapidly becoming the standard for ensuring product integrity. Chain of Compliance is establishing full traceability of the equipment and processes used in managing the environmental control of the commodity. This includes container performance and requalification history, commodity history, courier handling and performance history, calibration history, and correlation competencies that can link in field events to equipment performance.

The reason that the FDA and other regulatory bodies are interested in Chain of Compliance is that it provides the ability to collect, interpret, and leverage comprehensive data, enabling a significantly more intelligent supply chain. Rather than reactively trying to determine what has gone wrong after multiple failures, it becomes possible to take a proactive approach. Moreover, effective implementation provides historical traceability of logistics processes, equipment, and third-party support entities, enabling one to critically assess its complete supply chain and minimise failures and risk.

Regenerative medicine is revolutionising the treatment of diseases and promises to rapidly scale in the coming quarters, putting additional stress on supply chains used to distribute therapies globally that have no tolerance for temperature excursions. Carefully engineering your cold chain to support these therapies is critical if one is to be able to successfully distribute these therapies on a global basis.