Asia is embarking on an energy transition journey as market dynamics and emerging technologies drive the need to evolve. Considering the diversity of the Asia region in terms of existing power infrastructure and future demand, each country’s strategic approach towards meeting its growth is significantly different.

Existing grid infrastructures are running close to full capacity to meet the surge in energy consumption generated by the region’s rapid population growth and economic development.

Indonesia suffered a blackout across Greater Jakarta and West Java that affected millions in Jakarta. Disruption in the transmission conductor at one of the power plants was identified as the culprit.

Vietnam anticipates that its demand for electricity will exceed its supply by 6.6 billion kilowatt hours (kWh) in 2021. The electricity shortfall will increase to 15 billion kWh by 2023.

At the same, over 700 million people in Asia Pacific are without access to electricity.

Having access to clean and affordable energy is the key to bringing universal growth across all sections of the society and alleviating poverty.

OPPORTUNITIES IN ENERGY TRANSITION

The energy transition presents an opportunity for Asia governments to expand and upgrade their grid infrastructure to support the ferocious growth without compromising on availability, affordability and sustainability.

Asia needs to continue with its commitment to universal electrification, sustainability and improvement in energy efficiency by investing in integrated power infrastructure as it re-balances its energy portfolio.

An integrated power infrastructure takes advantage of different generation, transmission and distribution technologies to help utilities overcome the pitfalls of aging infrastructure assets while meeting rising customer demand for energy that is renewable and reliable.

While generation from clean and sustainable energy rises, conventional power generation remains a cost-effective baseload mainstay for many developing economies as governments strive to electrify populations in remote areas.

The regional investment direction is in line with the findings in Black & Veatch’s 2019 Strategic Directions: Electric Industry Report. Respondents to our annual survey of the electric industry agreed that there is a need to have a balanced generation mix with a diversity of fuel choices to meet energy demand with reliable baseload generation.

Investments are anticipated to be driven by the region’s electrification demand and new technologies; sustainability priorities; and the need for bankable solutions.

New consumption drivers such as electric vehicles (EVs) elevate the urgency of energy transition success. Estimates in Southeast Asia indicate that by 2025, 20 percent of passenger automobiles could be electrified to meet the region’s growing demand for mobility and sustainability.

Indonesia is targeting for EV production to start in 2022 and aims for the share of EV output to reach 20% of total car production by 2025.

The focus on EVs in India’s 2019 Union Budget will improve the longer-term outlook for EV sales, placing new demands on the grid.

DISTRIBUTED INFRASTRUCTURE STRATEGIES

Regional governments have discovered opportunities for grid-connected generation and distributed power generation.

For example, distributed power generation incorporating renewable energy sources, or microgrids, offer autonomous energy that is efficient, reliable and environmentally friendly for places that are prone to natural disasters or have little infrastructure.

Microgrids and hybrid systems ease strains on the national grid while enabling a more reliable and consistent supply of power by stabilizing fluctuations in output from the intermittent renewable resources. By optimizing output and reducing variability, these systems improve the bankability of renewable energy projects.

To substantially increase the share of renewable energy in the energy mix, regional governments are investing in battery storage systems and conventional gas-fired plants to stabilize the grid by mitigating intermittency issues of renewable energy.

EXPANDING CAPACITY THROUGH DIGITAL TRANSFORMATION

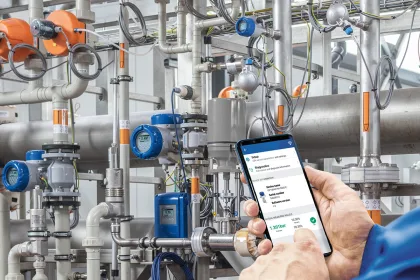

Internet of Things, artificial intelligence and smart grids are key digital transformation opportunities that regional governments are tapping on to manage the energy transition and optimize the impact of individual technologies. Industry analysts forecast that countries in Southeast Asia will invest $9.8bn in smart grid infrastructure between now and 2027.

One opportunity the region is considering is the remote and integrated management of assets for the complete value chain through data analytics and predictive maintenance.

Digital transformations address core challenges of grid stabilization, peak load management, system flexibility and reliability in a holistic manner. Core benefits of digital transformations include improving efficiency and reducing downtime by offering competitive advantages that drive lower-cost and higher-value solutions plus better-managed project execution.

To address market dynamics and emerging technologies, grid investments must be made holistically to deliver on consumer expectations as the energy transformation deadline accelerates.

STRATEGIES FOR ENERGY TRANSFORMATION SUCCESS

- Regional leadership is critical:

Understanding of a truly integrated power infrastructure; as well as knowledge of technologies and the ability to integrate those is critical to energy transition success - Identify business partners who can mitigate project risks:

Business partners who provide quality engineering, procurement and construction solutions at varying scales with consistent execution and safety practices can help minimize risk factors, making projects more bankable and revenue more certain. - Rely on experts:

Experts with asset management tools and processes can help address challenges with existing plants and facilities and extend their useful life, improving efficiency and implementing remote monitoring tools that diagnosis problems before they occur. - Regional teams, global best practices:

Collaborate with regional experts who bring global best practices, tailored to local need to mitigate business risks and overcome complexity from planning and development to construction and operations. - Identify opportunities in complexities:

Invest in strategies that address complex issues of resilience and reliability, sustainability and affordability

Narsingh Chaudhary is Executive Vice President, Asia Power Business at Black & Veatch. Chaudhary joins Black & Veatch with more than 25 years of experience leading various energy businesses in the Asia region and globally. In his former role with Siemens, he developed and implemented energy projects in various countries including Southeast Asia. Chaudhary is based in Bangkok.

Written by: Narsingh Chaudhary, Executive Vice President, Asia Power Business at Black & Veatch