Philippines Presents Opportunity for Singapore Companies

With the Philippines going through an economic resurgence driven by domestic demand and economic reforms, there will be opportunities for Singapore companies as demand for consumer goods and infrastructure development in the Philippines rises, said Minister for Trade and Industry Lim Hng Kiang.

Q4 Sees Philippines Economy on the Rebound

Philippine economic growth accelerated last quarter as government spending and manufacturing output rose, capping the best three years of expansion since the mid-1950s.

Vietnam to Achieve $15 Billion Bilateral Trade with India by 2020

After achieving a two-way commerce to the sum of $8.03 billion in 2013-14, Vietnam is seeking to further increase its cooperation and investments across key sectors with India.

Bank of Japan Share More Upbeat View on Economy

The Bank of Japan on Friday (Dec 19) struck a more upbeat view of the world’s number three economy, saying exports were showing signs of picking up while factory output has started to “bottom out”.

Nikkei boosted by weaker yen and oil price fall

Japan’s Nikkei index closed at its highest level for two weeks, with exporters boosted by a weaker yen and airlines helped by falling oil prices.

OCBC and UOB eye Bank Licences in Myanmar

OCBC Bank and UOB have both confirmed that they have been granted preliminary approval for foreign bank licences to operate in Myanmar.

Asia Commercial Real Estate set to Boom

Transaction volumes of commercial real estate in the Asia-Pacific region are set to rise dramatically in the second half of this year.

Singapore 4th Most Expensive City in the World for Expats

Singapore has climbed one place to become the fourth most expensive city in the world for expatriates.

Malaysia Banks in Mega-Merger Talks

Three of Malaysia’s largest financial institutions are in talks to combine their businesses, in a move that would create one of southeast Asia’s biggest lenders by assets as well as build what they said would be a “mega Islamic bank”.

Singapore Hosts Global Islamic Banking Conference Next Week

The 5th Annual World Islamic Banking Conference takes advantage of the increasing trade and investment flows between the Middle East and Asia.

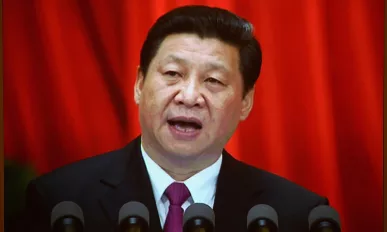

China’s Economy May Have Already Surpassed the US

An update on the previous news that China is set to overtake the US economy may have already happened.

China is Pressing for Vast Asia-Pacific Free Trade Agreement

China is pushing for a significant Asia-Pacific free trade agreement, as a rival US-led deal that excludes the country is yet to reach an agreement.